Acquire the right companies – not just

the obvious ones.

It’s the result of strategy, built on comprehensive and objective analysis, allowing for dynamic adaptions.

At MADiscover, our unique combination of big data, AI, and human expertise delivers exactly that. Dynamic Strategic Landscapes full of actionable insights. Explore our Solutions, see the Technology behind the approach, or browse our latest Resources.

M&A screening shouldn’t be this hard

M&A teams teams face mounting pressure to identify the right targets faster, but traditional screening methods are broken.

Manual Screening

Corporate development teams spend weeks manually researching and screening potential acquisition targets, delaying strategic decisions.

Biased Analysis

When comprehensive and objective analysis becomes complex, too often they are replaced by biased or political decision-making. For decades this was considered as the natural cost of complexity in M&A.

Limited Results

Traditional shortlists are often imprecise and rarely dynamic. Re-ranking, revising, or re-evaluating with different parameters and from multiple angles is almost impossible. And above all, none withstand the valid question “Is this the best insight we can get?”

M&A Screening Redefined

From Data To Strategy

Strategic fit is evaluated from individually defined angles and priorities, supported by financial metrics. The result: unique market insights that are decisive for better acquisitions and strategic partnerships.

No market is too large or too complex to be fully mapped according to the criteria set by our clients. By combining predictive and AI algorithms, we provide the most objective way to quantify strategic fit. We at MADiscover eliminate biases rooted in personal networks and preferences, or limited research capacity.

Strategies evolve, as externalities are increasingly dynamic and adaptable – and so are our results. When priorities shift or new criteria emerge, our MADiscover Landscapes adapt accordingly, ensuring your insights reflect the latest strategic context.

Forget lists.

Get a Dynamic Strategic Landscape

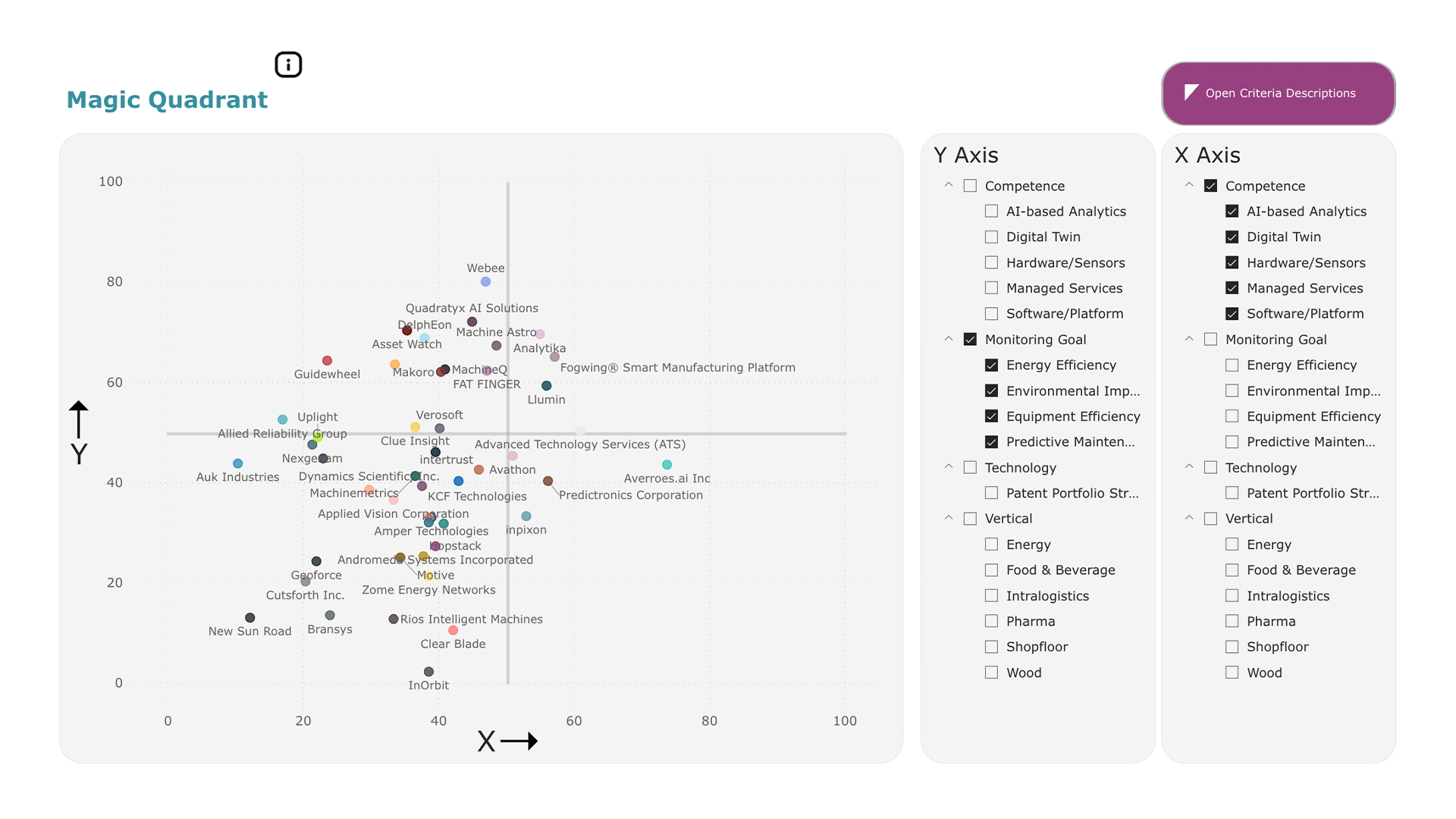

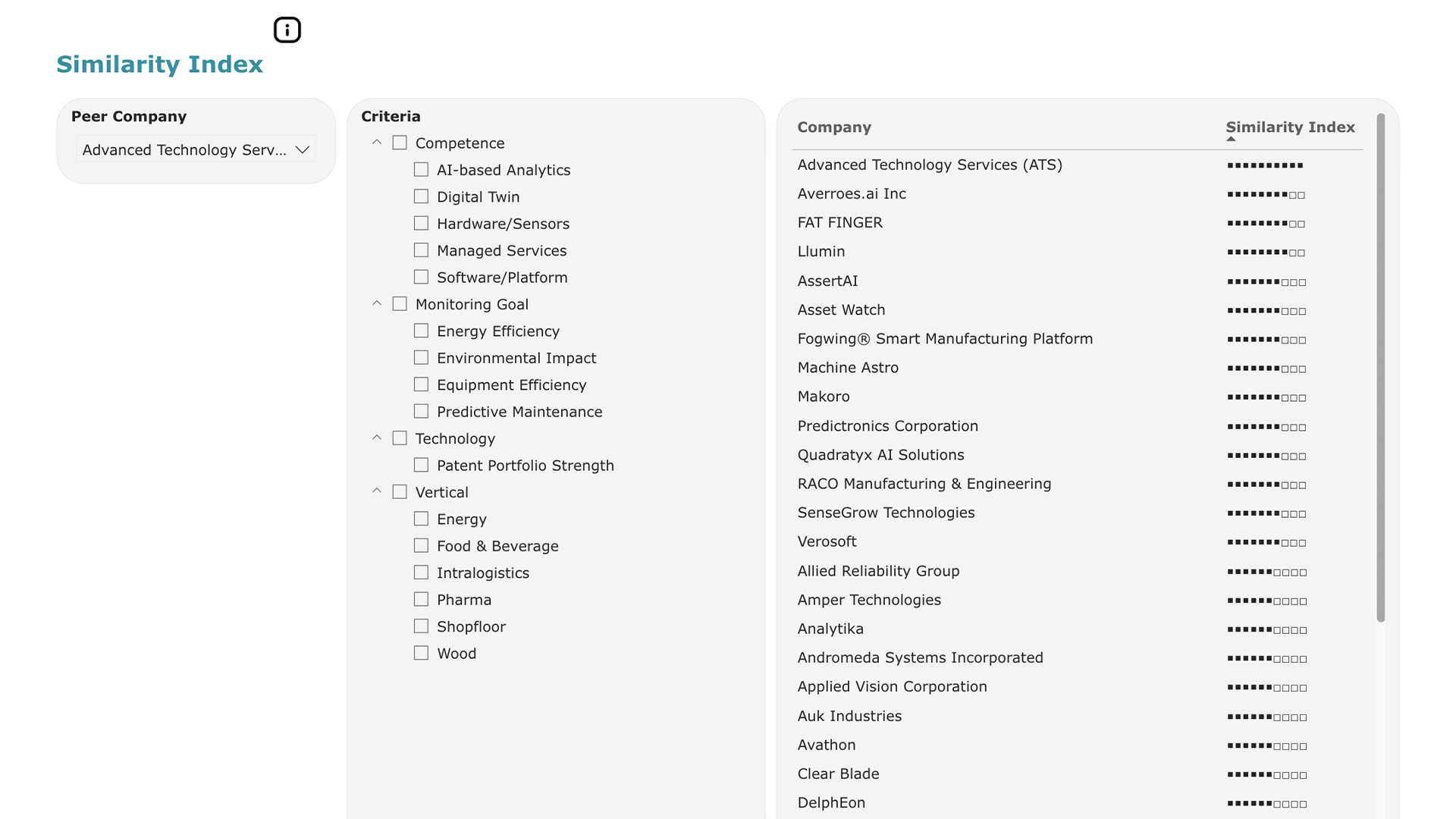

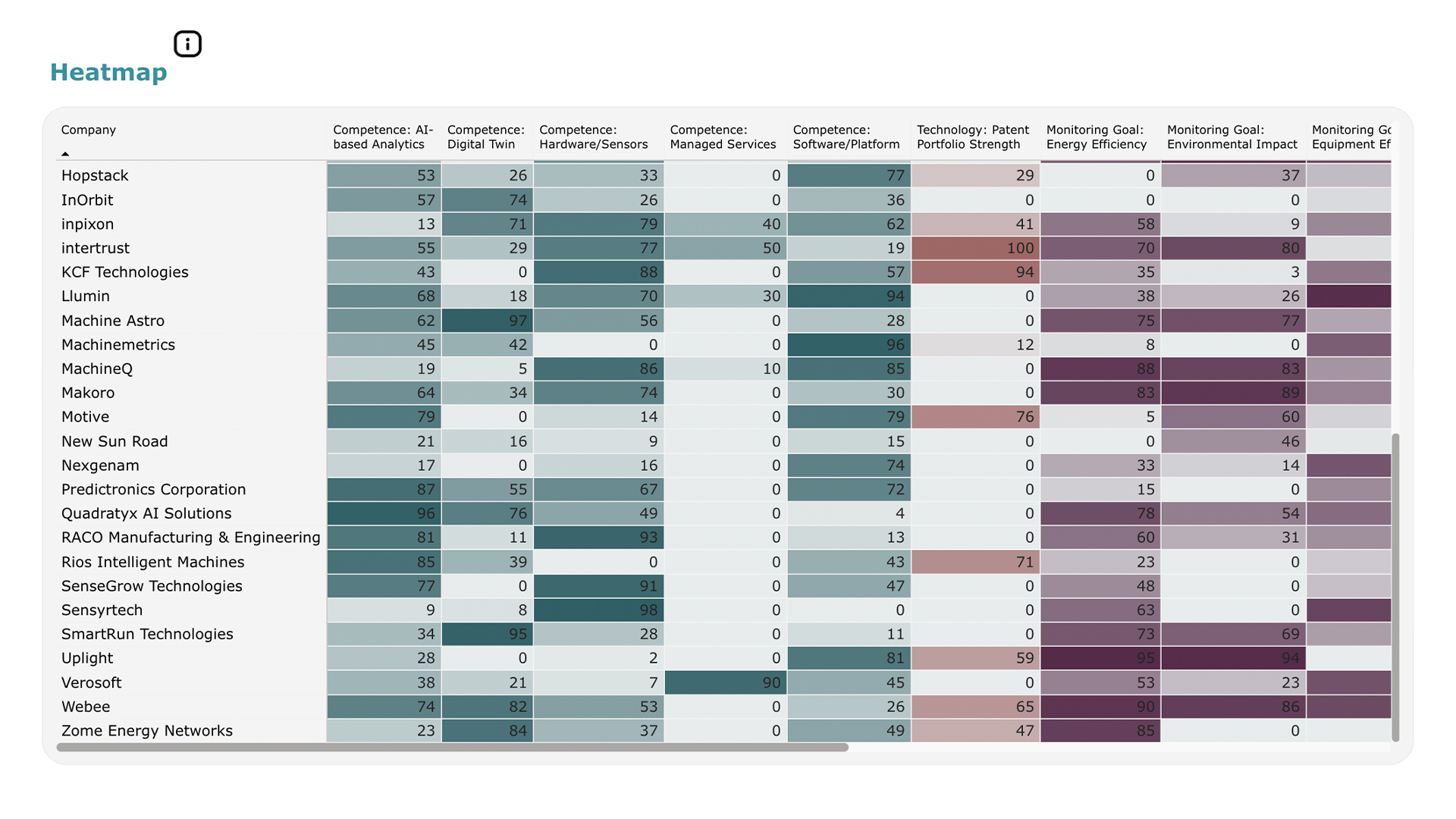

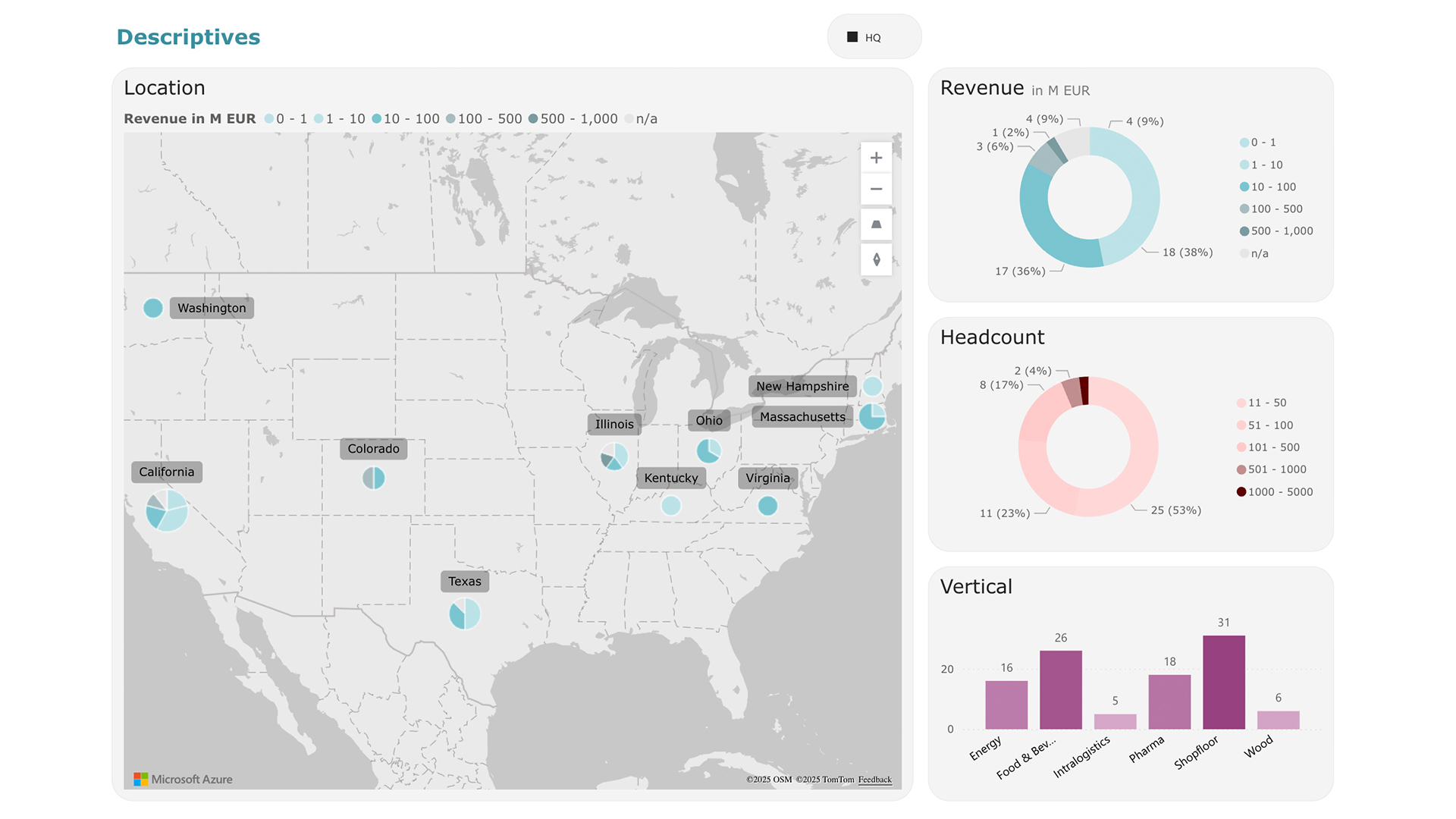

Dynamic Strategic Landscapes – resulting from comprehensive and objective analytics. Comparisons of up to hundreds of companies along individualized strategic criteria. Rich profiles including financial metrics, news feed, and patent data. See our Whitepaper.

“For too long, M&A success depended on luck. We change that – combining strategy, technology and expertise.”

Mai Anh Dao

CEO & Co-Founder

MADiscover in a nutshell.

Across the globe and across industries, screening and analyzing markets is what we do every day at MADiscover – uncovering actionable insights wherever they may hide.

90%

Less effort. Within just a few hours of input, our clients translate their strategic rationale into a Landscape full of insights and opportunities.

5M

We at MADiscover have screened millions of companies, comparing competences, business models, and strategic criteria against each other.

150+

Countries. We deliver Landscapes with companies from all over the world in more than 150 different countries.

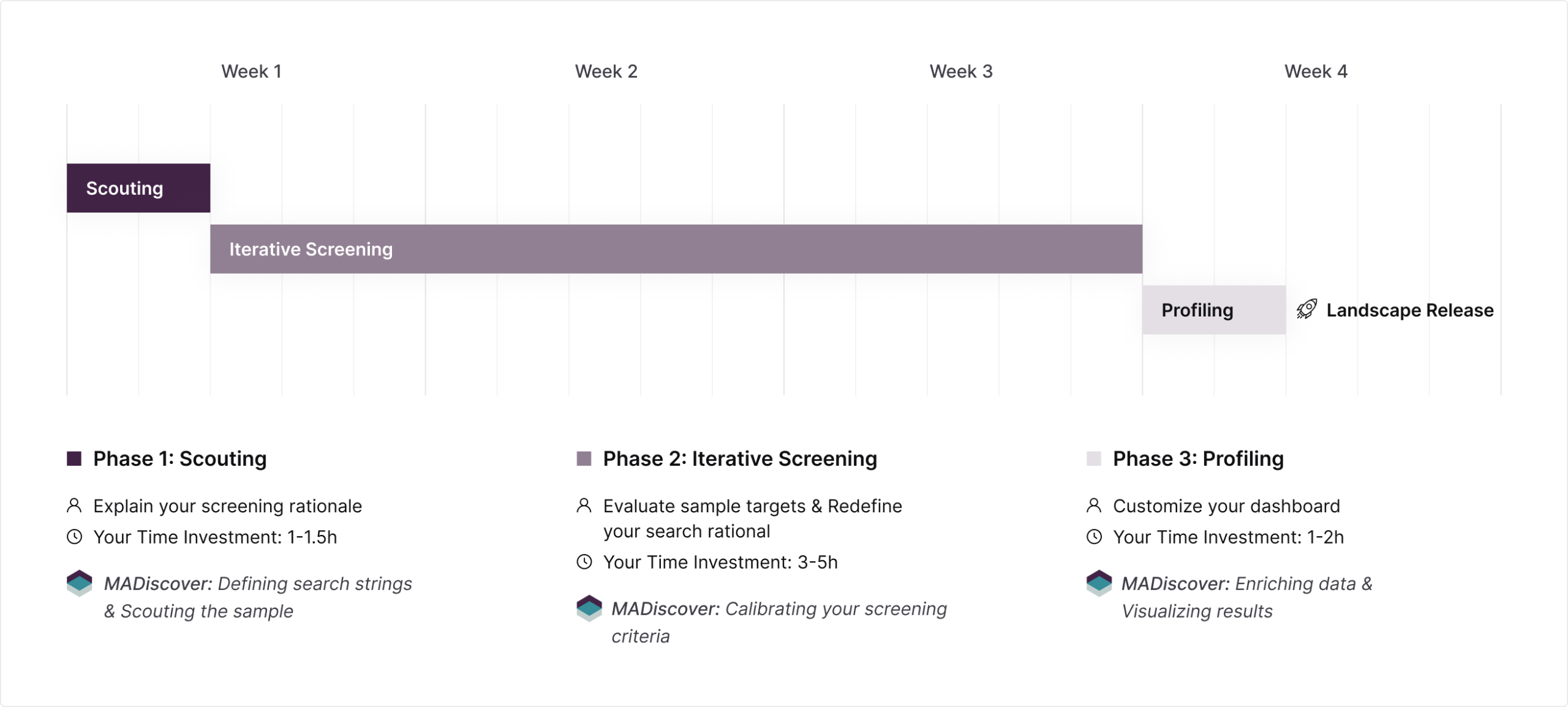

From strategy to actionable market insights in less than 4 weeks.

Our structured approach ensures you move from identifying targets to closing deals with speed and confidence.